The broker features a trading platform that provides stock, ETF, crypto, and options trading at affordable rates.

- Stocks and ETF trading is commission-free

- User-friendly trading platform with a straightforward account opening procedure

- Operates seamlessly on desktop and mobile devices

- Reliable 24/7 support service

- Plenty of learning resources for skills development

- Limited product offerings

- Withdrawal charges apply

Active or day traders looking for a reliable broker offering a variety of trading tools should consider TradeZero. The broker features a trading platform that provides stock, ETF, crypto, and options trading at affordable rates. If you are a newbie, we help you understand TradeZero features, including its fees, trading tools, security, etc., to decide whether it is worth investing in. Remember, a broker must meet all your trading requirements for you to enjoy your experience and increase your chances of succeeding.

TradeZero – Who Are They?

Founded in 2015 by Daniel Pipitone, TradeZero is an online brokerage firm offering stocks, cryptocurrencies, ETFs, and options trading services. It is headquartered in the Bahamas but offers its services to traders globally. The broker has a user-friendly platform and a straightforward account opening procedure. In this regard, we primarily recommend it for newbies since it also features adequate learning resources to boost your skill level.

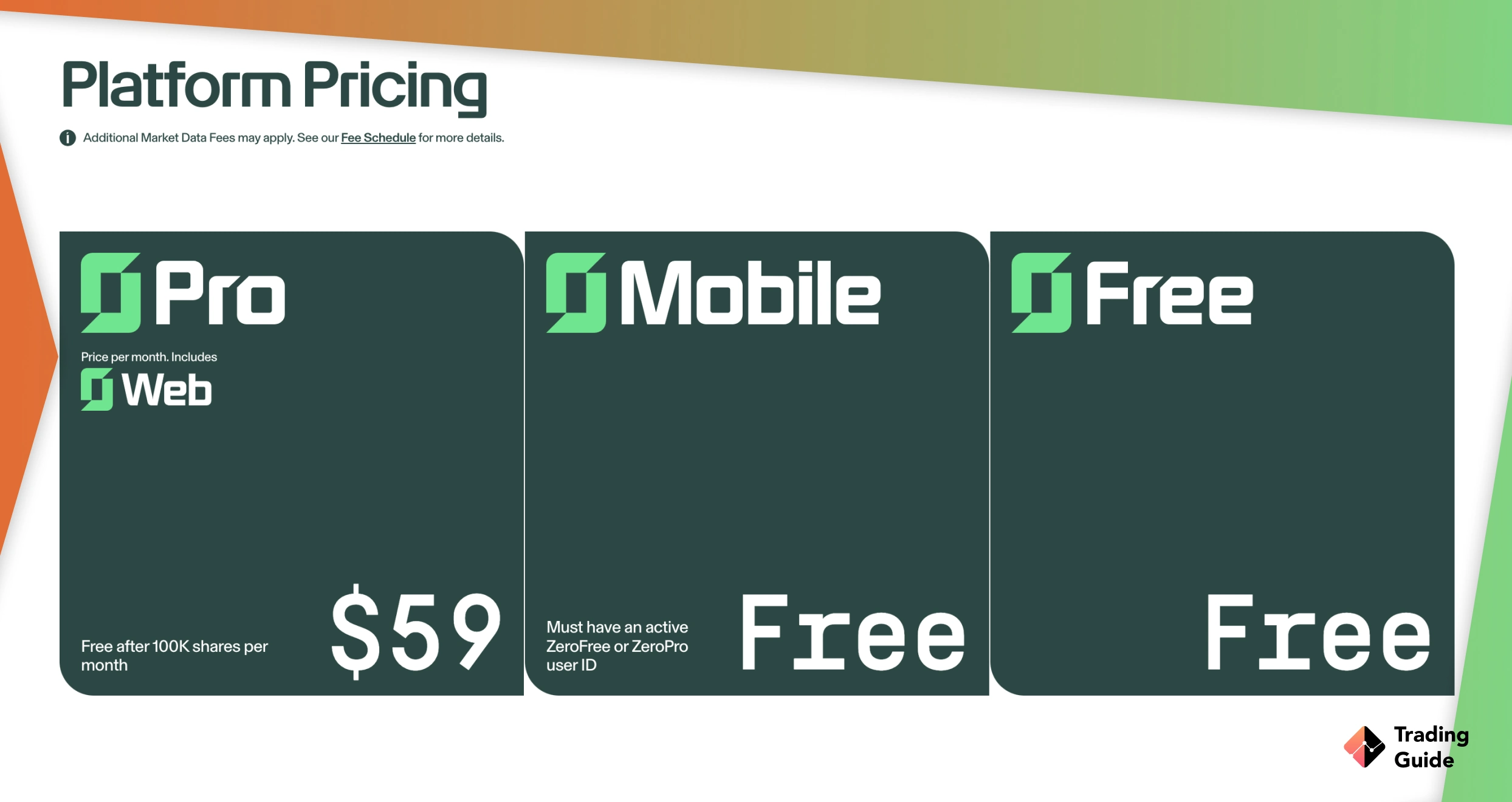

TradeZero is a safe stock broker since it is licensed and regulated by world-renowned authorities. It features three branches, including TradeZero America, TradeZero International, and TradeZero Canada, all of which traders get to choose based on their jurisdictions. On top of that, the broker hosts different platforms for traders, including ZeroPro, ZeroWeb, ZeroFree, and ZeroMobile. You can get started with the broker with as little as £250.

Compare TradeZero with Other Brokers

Compare brokers

Licences and Security

TradeZero is a trusted broker since it is highly encrypted to secure your trading data and personal information. Besides securing your funds in a separate account, the broker is also licensed and regulated by top-tier authorities, the Securities and Exchange Commission (SEC), The Securities Commission of The Bahamas, and the Financial Industry Regulatory Authority (FINRA).

Besides being licensed and regulated, TradeZero America offers standard protection to US traders through the Securities Investor Protection Corporation (SIPC). TradeZero international clients also get to benefit from the Excess SIPC insurance protection, thus guaranteeing their funds’ safety. On top of that, the company continues to receive excellent testimonials from users on Google Play, the App Store, and Trustpilot.

Assets Offered

Unfortunately, TradeZero doesn’t host as many trading assets as most of its peers. With it, you only get to trade stocks, options, ETFs, and cryptocurrencies. Therefore, if you are a trader looking for platforms offering assets like mutual funds, forex, indices, futures, etc., you may want to consider other options.

TradeZero Fees, Commission, and Spread

TradeZero trading services are commission-free whether you select stocks, ETFs, or cryptocurrencies. Its transparency regarding trading charges is one of the reasons thousands of traders trust the platform. Its account registration is free, and you will not incur any fee when making deposits.

In addition, TradeZero does not charge an inactivity fee, but it is advisable to remain an active trader to quickly improve your trading skills and become independent. Sadly, you will pay a £50 withdrawal fee with this broker. Therefore, ensure TradeZero’s spreads and additional charges fit your budget to enjoy your experience.

| Type | Fee |

|---|---|

| Minimum deposit | £500 |

| Deposit fee | £0 |

| Withdrawal fee | $50 |

| Inactivity fee | £0 |

| Overnight fee | £0 |

Deposit Methods and Supported Currencies

TradeZero allow transactions through bank transfers only. You will not make deposits or withdrawals using other options such as debit/credit cards or e-wallets like PayPal. Remember, making deposits is free, but you will incur withdrawal charges. Plus, deposits are only accepted through an account registered in your name. Therefore, ensure your name on the trading account matches the one in your bank account for streamlined transactions.

When it comes to supported currencies, TradeZero only allows transactions in USD. This means that if you make deposits in other currencies, a currency conversion fee applies.

Platform and Research Tools

TradeZero’s trading platform is user-friendly with an intuitive design. Its search function is also excellent and offers various order types, including stop-loss orders to mitigate massive losses. Besides operating on the web via its ZeroWeb platform, TradeZero is also compatible with mobile devices, and you can enjoy it through the ZeroMobile platform. For desktop users, the broker offers a ZeroPro platform for seamless trading activities.

When it comes to trading tools, the broker features an excellent interactive chart and quality news flow. Unfortunately, it doesn’t host additional advanced resources to help with skills development. The good news is that newbies will benefit from its quality learning resources and a virtually-funded demo account to test the broker and gauge their skill level before investing their real money. TradeZero also has a dedicated and reliable support service operating 24/7 via phone, email, and live chart.

How To Register a TradeZero Account

TradeZero account opening procedure is pretty straightforward and will only take minutes to complete. To ensure you are fully prepared, we explain all the procedures below. However, before getting started, ensure TradeZero is suitable for your needs and install its trading app on your mobile device if you want to trade on the go. Also, read and understand its terms and conditions to avoid future inconveniences once you are fully invested.

- The first thing you need to do to register for an account with TradeZero is to visit the broker’s website. We share links on this page to help you quickly access the TradeZero website.

- Once on the website, begin the registration procedure by selecting your preferred account based on your jurisdiction. The account can be TradeZero America, TradeZero International, or TradeZero Canada.

- Share your personal details, including your name, email, phone number, etc. It is also mandatory to create a username and password for securely logging into your trading account.

- The next step is to verify your identity by sharing a copy of your original identity card, passport, or driver’s license. As part of its protocol, TradeZero also requires that you verify your location by sharing a copy of a recent utility bill or bank statement.

- TradeZero will review your shared documents for verification and fully activate your account. At this point, you can make a deposit (£500) using the bank transfer method at zero charges.

- Once your deposit is confirmed, TradeZero will automatically redirect you to the respective exchanges that list various stocks to trade. You will also have access to its platform for other asset offerings to choose from.

Remember, before investing real money, test TradeZero via its virtually funded demo account. When placing trades, take advantage of its featured stop-loss and take-profit orders to curtail massive losses in case a trade doesn’t work in your favour.

Editor’s note

Traders and investors sceptical about using TradeZero should note that the broker is safe. In addition, it offers commission-free trading services to options, stocks, ETFs, and cryptocurrency traders. Its platform is also user-friendly and features adequate trading tools to boost your skills and experience. However, if you are a professional trader, TradeZero might not be an excellent choice since it offers limited advanced research resources.

Although many traders may find TradeZero costly due to the high minimum deposit requirement and withdrawal fees, its mobile app is reliable and helps you trade on the go. We also like the broker’s support service operating round the clock, thus ensuring you get all the assistance you need at any time. Overall, we recommend TradeZero but ensure it suits your trading needs before making a commitment.

FAQs

No. Although TradeZero has three different accounts, it doesn’t accept UK clients. The broker is not regulated by the Financial Conduct Authority (FCA), UK’s financial regulator.

Registering for an account at TradeZero is free of charge. However, the broker has a minimum deposit requirement of £500, which you must make via the bank transfer method.

Yes. Users on the ZeroWeb and ZeroPro platforms have an opportunity to explore numerous trading resources that maximise their potential. In this regard, they will pay a $59 per month fee if their accounts have less than $50,000.

The good news is that the broker also hosts ZeroMobile and ZeroFree accounts that do not attract monthly charges. However, the accounts miss some essential features that might increase your success chances.

TradeZero prides itself on processing withdrawals on the same day through the ACH transfer option. However, you must submit the request by 2:30 pm EST and meet additional withdrawal conditions. Overall, expect your withdrawal request to be completed within three business days.

No. TradeZero does not have an inactivity fee. However, it is crucial to remain disciplined and frequently trade if you want to quickly advance your skill level and become independent.

Besides the options contract fees, TradeZero earns profit from the spreads it collects from traders. It also earns more from withdrawal charges and the $59 monthly fee it collects from traders using the ZeroWeb and ZeroPro platforms.

How we test?

Our test process is really based on two different aspects: our independent tests and research, as well as user reviews from Google Play, the App Store, and Trustpilot, etc.

The first thing we do when testing is to check every detail and test every tool and instrument. Our experts spend more than 200 hours on every article. We pay special attention to the specific function or the criteria that we’re comparing during the comparing stage. This means that we must determine which broker is more suited for beginners, and which is better suited for experts, for example. Find out more about our test process here.

This is the best trading platform for serious traders. They know their customers and treat them well. The online support chat was very helpful, it only took a few minutes. Good spreads, software, updates.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal